Closed Fracture Care with Manipulation

Photo by Freepik

Closed treatment fracture care coding has been the topic of discussion and debate, for many years, especially when no fracture reduction/manipulation occurred. However, we are going to mainly discuss scenarios that include a reduction, and how to report them correctly. There are a few things to consider when deciding how to code these services.

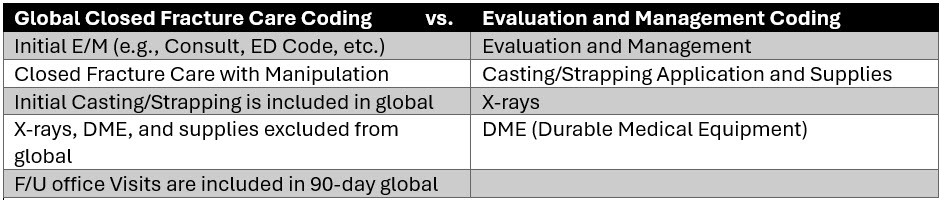

The most common billing question we get is, should we report a fracture care code or an evaluation and management service? The answer is maybe both, especially when restoration is involved. The AMA endorses both coding scenarios. However, there are some caveats and best practice recommendations. Let’s review a few definitions.

Definitions

- Restorative Care = Closed treatment with manipulation (reduction) – techniques to restore the bone to proper position are traction, flexion/extension, and/or medial/lateral rotation, followed up by immobilization.

- If ED physician/ACP provides restorative care but will not be following the patient in post-op, they should report CFC (Closed Fracture Care) with a -54 (surgery only) modifier. Orthopedics can report same code with -55 (post-op only).

- Definitive Care = Closed treatment without manipulation – this typically includes pain management and immobilization (casting, strapping, splinting, etc.).

- If physician/ACP are not going to be providing follow-up care, it is best for ED provider to report services with appropriate E/M + cast application codes.

For displaced fractures treated with restorative care, it is appropriate to report your initial visit (E/M service) and the appropriate closed fracture care with manipulation code. Add the -57 modifier to your E/M service to demonstrate the decision for surgery (90-day surgical global) was made at that encounter. This enables you to report both an E/M service and your manipulation procedure code.

Example:

Plot twists

Sometimes a physician or APP (Advance Practice Provider) only provides a portion of the service. What is the appropriate thing to do in those scenarios? Depends on who is doing what, and where. Let’s review a few of these coding plot twists. Keep in mind, that Medicare considers everyone in your group practice a single provider. So regardless of whether an NP/PA sees the patient initially, or a physician, you are still a part of the same group practice. There are some caveats if your group practice has specialists that fall under separate taxonomy codes, but we won’t go into that in this article.

Plot Twist Example One:

PA sees patient in Emergency Department and performs reduction but does not perform any follow-up services in the office/clinic setting. A physician within the group practice performs the post-op care.

In this scenario, the PA may report their initial visit (e.g., Consultative Service) and the reduction with the appropriate modifiers. Remember, CMS considers Advance Practice Providers (APP) and physicians in the same group practice, a single provider. Internally, perhaps something could be worked out where the physician performing the post-op care (21% RVU) can be credited for their work.

I haven’t found anything that would prohibit using the global surgery modifiers if you are in the same group practice. That said, remember you are considered a single provider by the payer. Typically, you would use these modifiers when providers of different group practices participated in the patient’s care. There’s also that site of service differential to consider (office/clinic setting vs. emergency department).

Reporting closed fracture services performed by providers in the same group using the global surgery modifiers complicates the who, what, when, where, and how to report the global service.

First Consideration

Keep in mind the reduction actually took place in the emergency department (POS 23), and the post-op care is billed by another provider in the same group practice (in the office), POS 11. The office/clinic setting reimburses higher than the facility-rate due to consideration of practice overhead. This billing scenario could only be accomplished by using the global surgery modifiers. Otherwise, the post-operative management reimbursement would be bundled into the PA’s original reduction code and reimbursed at the PA rate (85%).

Second Consideration

The second thing to keep in mind when unbundling the global period is that the physician (100% MPFS) will also be reimbursed at a higher rate than the PA (85% MPFS).

Third Consideration

Lastly, the appropriate coding/billing scenario should always be accurately reported as to where and when the service took place, and who performed/rendered the service.

For reference, the global surgery modifiers are listed below.

CPT Procedure Modifiers

–54 Modifier: Surgical Care Only (69% wRVU)

–55 Modifier: Post-Operative Care Only (21% wRVU)

–56 Modifier: Pre-Operative Care Only (10% wRVU)

Evaluation and Management Services

-57 Modifier: Decision for Surgery (90-Day Global)

Plot Twist Example Two:

PA sees patient in the emergency room and stabilizes the fracture with casting and strapping only. The patient follows up with the Orthopedic Surgeon in the office.

In this scenario, it is perfectly acceptable for the PA to report only the consultative service (not a closed fracture code) and any casting/splint application code that’s performed to stabilize the injury. The PA immobilized but did not manipulate the fracture in any way. The orthopedic surgeon can decide in the office, whether or not to report fracture care or E/M services based on the nature of the patient’s injury.

In summary, these cases should always be considered on a case-by-case basis.

Resources:

AAPC: Fractures 101-Let’s Cover the Basics

AAPC: Tricky ED Fracture Care Coding

AAPC: Billing Fractures in the ED

INFINX (blog): How to Accurately Code Closed Fracture Care

ACEP: Orthopedic Fracture / Dislocation Management FAQ

CMS: Billing and Coding Fracture Care

CMS: Physician Fee Schedule Look-up Tool