“Incident to” – Still on the OIG radar

Image by: Pexels Pixabay

What is Incident-to?

Medicare Part B pays for physicians’ services and supplies that are provided by the physician’s staff, including non-physicians, as part of the physician’s care. These services must be directly supervised (think FEET in the SUITE!) by the doctor and are billed as if the doctor provided them.

Direct Supervision – in the office setting means the physician (or other supervising practitioner) must be present in the office suite and immediately available to furnish assistance and direction throughout the performance of the procedure. It does not mean that the physician (or other supervising practitioner) must be present in the room when the procedure is performed. Pub 100-02 Medicare Benefit Policy

Medicare pays the full physician rate as if the physician performed the service themselves. It’s important to make sure incident-to services are in compliance with the program’s requirements. The OIG’s goal is to report on whether Medicare Part B payments for these services meet Medicare’s rules. The report is expected to be published in 2026.

How will the OIG know which services to review? Incident-to services are reported by the supervising physician; therefore, the rendering provider is typically invisible. It’s like trying to find a needle in a haystack. You can’t just run a report like you can for a particular CPT/HCPCS code. There isn’t a modifier, (e.g., FS – Shared/Split services) to drill down on. So how will they identify services to review?

The impossible day. That’s how. OIG may not be able to run a report directly to identify the service, but they can data mine for outliers that have impossible days. Those physicians that report more services than they can possibly perform independently in a given day. Most of the time, however, these services are discovered by internal reviews that are self-reported to the OIG. Below, are some of the ways we get it wrong.

Where do we usually go wrong?

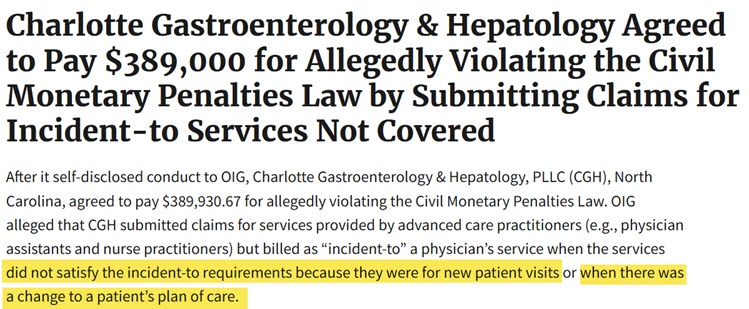

Evaluation and Management Services reported under incident-to must be established patients with established plans of care occurring under direct supervision. Where we go wrong is reporting new patient visits, sometimes shared with the physician and/or new problems, incident-to. Those services should be reported directly by the advance practice provider. OIG Self-Disclosure Case

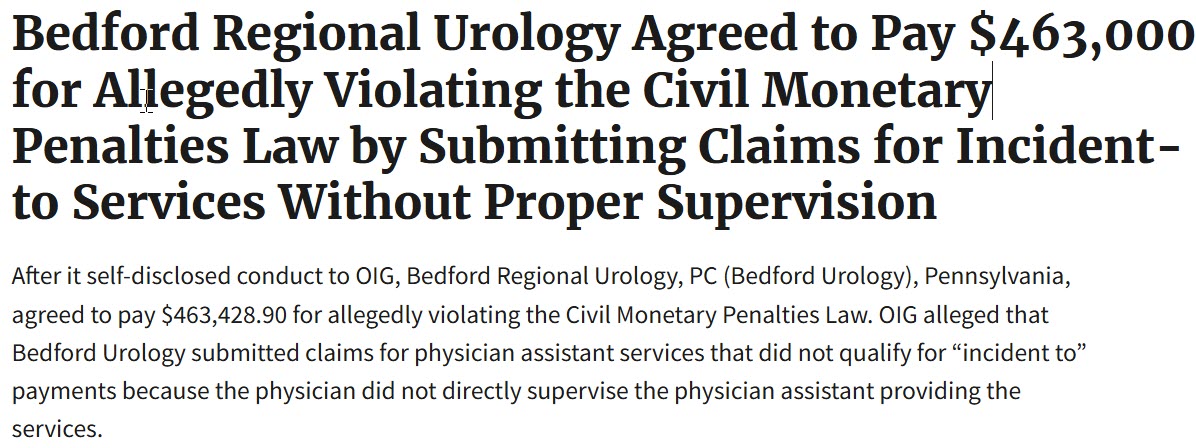

Another area we get wrong is in-office procedures without the appropriate direct physician supervision. If the service is within the rendering provider’s scope of practice, they should report the service directly for payment. OIG Urology self-disclosure case.

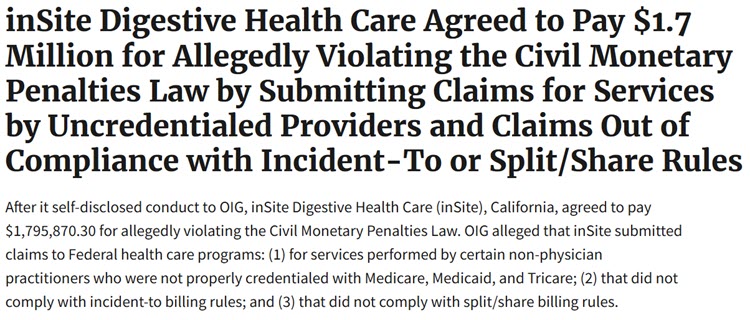

One of the most expensive self-disclosures was from inSite Digestive Health Care, to the tune of $1.7 million dollars.

It’s clear that the requirements for Incident-to are still confusing and complex for many. For that reason and others, it remains on the 2025 OIG Work Plan’s Active List.

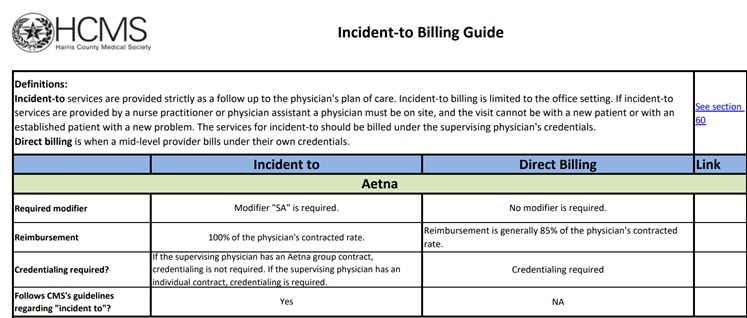

NEWS! According to the TMA (Texas Medical Association), effective April 1, 2025, Aetna will cut pay for care provided by Advance Practice Providers by 15% – whether reported as incident-to or not.

Aetna has always required the SA modifier when reporting services incident-to. Beginning April 1, 2025, they are requiring either an SA (NP) or SB (CNM) modifier to identify which type of advance practice service was rendered the service regardless of direct or incident-to billing. Although some payers use the modifiers to identify different things. Essentially, no more incident-to billing for Aetna patients. More and more payers may follow suit. BCBS Anthem also went this route last summer. Looks like Incident-to isn’t just on the OIG’s radar. Stay tuned!

UPDATE (02/10/2025): Aetna walks back this decision per the TMA.

Image Credit: HCMS

If you have questions, please do not hesitate to reach out to [email protected] or [email protected].

Resources

(MSHBC) Incident-to Billing Basics

MSHBC (Internal) Incident-to Infographic

(HCMS) Harris County Medical Society – Incident-to Billing Guide

(OIG)Office of Inspector General Search Page

Novitas Provider Specialty: “Incident-to” Page

NAMAS – Revisiting Incident to

Federal Register – 410.26 Services Incident-to a Provider